Qatar quits OPEC as Saudis walk tightrope on oil prices

As ministers from OPEC and other major oil producing countries prepare to gather in Vienna for a crucial meeting later this week, the cartel is absorbing yet another hit to its waning influence.

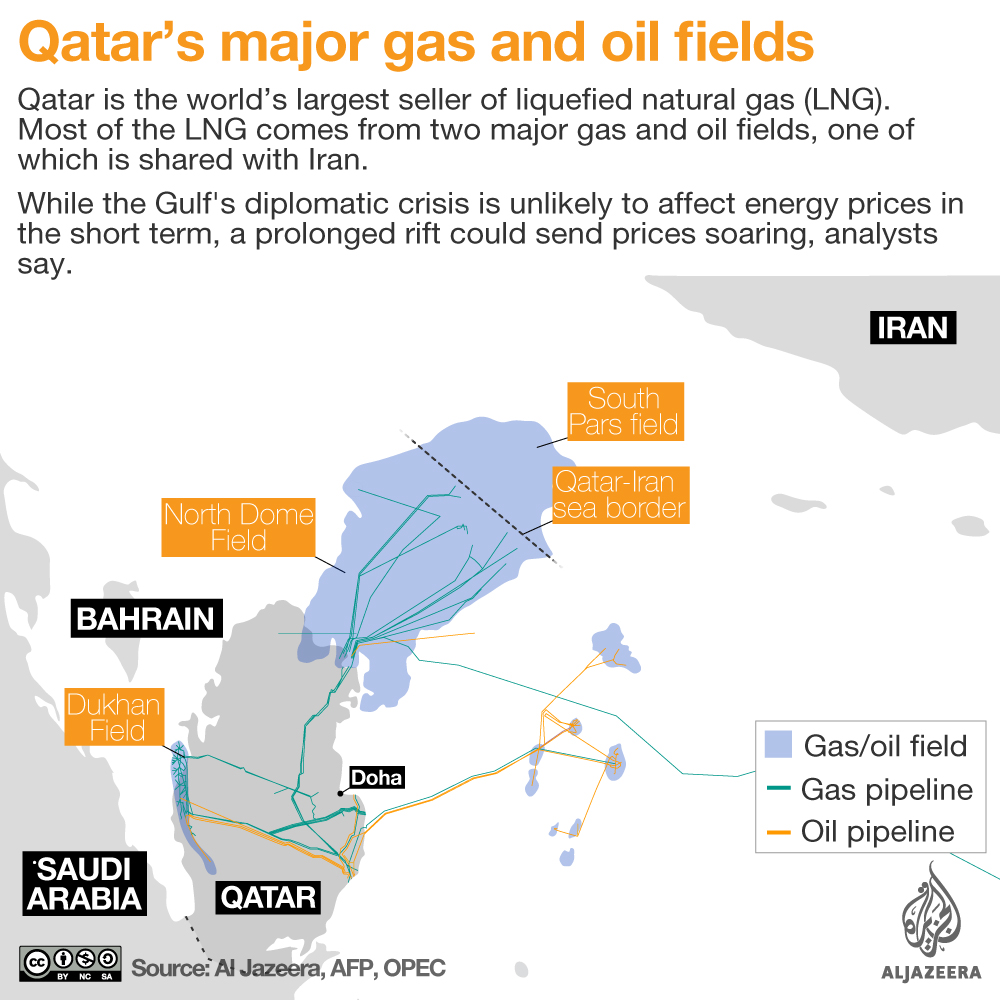

The latest blow to the Organization of Petroleum Exporting Countries (OPEC) was delivered on Monday when Qatar announced it’s quitting the bloc next month to focus on liquefied natural gas production.

Qatar is a relatively small oil producer and its decision to end its nearly six-decade-long membership in OPEC is not expected to have a major influence on energy prices.

Qatar’s Energy Minister, Saad Sherida al-Kaabi, dismissed the notion that the decision was driven by Doha’s ongoing feud with OPEC’s de facto leader Saudi Arabia. Riyadh has led a land, sea, and air blockade against the Qatar since June 2017.

Nevertheless, some analysts see Doha’s break with cartel as deeply symbolic, especially given the fact OPEC has in the past overcome major divisions to coordinate energy policy.

“More than anything, we suspect that Qatar’s withdrawal from OPEC has been spurred by its ongoing dispute with Saudi Arabia and its allies,” Jason Tuvey, Capital Economics senior emerging markets economist, wrote in a note to clients.

Amy Myers Jaffe, senior fellow at the Council on Foreign Relations, said Qatar’s decision underscores how the the blockade has added urgency to Doha’s slow drift from Riyadh’s sphere of influence.

“Qatar sought to reduce its exposure to Saudi oil policy and Saudi Arabia generally since the 1990s when the two countries first clashed over border disputes,” she told Al Jazeera. “Today, in light of the Saudi-led blockade against Doha, ensuring Qatar’s natural gas industry is independent of Saudi decision making on oil is all the more pressing.”

Ellen Wald, senior fellow at the Atlantic Council’s Global Energy Center told Al Jazeera that Qatar’s decision to leave the cartel could be a harbinger, as oil policy becomes more concentrated in the hands of Saudi Arabia and non-OPEC member Russia.

“It could signal that smaller producers are growing disgruntled with the cartel’s dominance by Saudi Arabia and Russia,” said Wald. “If a group of small producers decide to exit the cartel it will decrease OPEC’s influence in the market.”

|

Diminishing sway

Global energy markets have undergone a tectonic shift in recent years as the rise of US shale oil has moved the balance of power away from OPEC, diluting Saudi Arabia’s market power.

In 2016, with oil sliding below $30 a barrel, OPEC entered an alliance with Russia and other non-members to curb oil production and boost prices.

“Shale has pushed Saudi Arabia and Russia together,” Jim Krane, fellow at Rice University’s Baker Institute, told Al Jazeera. “These two countries, enemies throughout the Cold War, are now making common cause in oil markets.”

That common cause was on viral display over the weekend at the G20 in Argentina.

Russian President Vladimir Putin doubled down on his support for Saudi Crown Prince Mohammed bin Salman (MBS), despite widespread condemnation over the murder of dissent columnist Jamal Khaghoggi in the Saudi consulate in Istanbul.

Putin and MBS engaged in a headline grabbing high five on the opening day of the G20. On the closing day, Putin told reporters that Moscow had agreed to extend its production management pact with OPEC.

That announcement along with news that Canada’s biggest oil producing province is slashing output starting in January helped lift global benchmark crude Monday after a horrible stretch that saw prices slide from $85 a barrel at the start of October to around $60 by the end of November.

But despite the Putin-MBS public bromance and pronouncements of further cooperation, it’s uncertain how things will unfold this week in Vienna.

“It is not yet clear the pace at which Russia would be willing to reduce its output or the extent to which it will participate in cuts,” said the Council on Foreign Relations’ Jaffe.

Ahead of the G20, Putin said that he was fine with oil trading around $60 a barrel. Russia also has a flexible currency that helps offset the pain of falling oil prices.

Meanwhile, according to the IMF, Saudi Arabia needs oil to trade just above $73 a barrel next year to balance its budget.

The Trump factor

Most analysts believe OPEC and other major oil producers need to slash output by some 1.4 million barrels per day to meaningfully boost prices.

Even if Riyadh can get the rest of OPEC and Russia on board with that kind of cut, the kingdom will be walking a tightrope in Vienna, balancing its budgetary need for higher oil prices with the political imperative to stay in US President Donald Trump’s good graces.

“The Trump administration has both publicly and privately expressed the view that $70 to $80 oil is too high,” said Amy Myers Jaffe.

Trump has stood by MBS, dismissing reports that a CIA assessment concluded the crown prince ordered Khashoggi’s murder. The need to keep the president on side could eclipse the kingdom’s supply and demand considerations.

“The Saudis cannot afford to be price hawks right now,” said the Baker Institute’s Krane. “Trump’s notoriously fickle friendship could evaporate with a rise in the oil price.”

That balancing act has sparked speculation that any announcements out of Vienna on Thursday or Friday could be tempered.

“We think that the group will decide to reduce production at the upcoming meeting but any move will be fairly modest,” Tuvey of Capital Economics said. “Whether they announce the precise size of the cut is more difficult to call – OPEC tends to favour vagueness.”