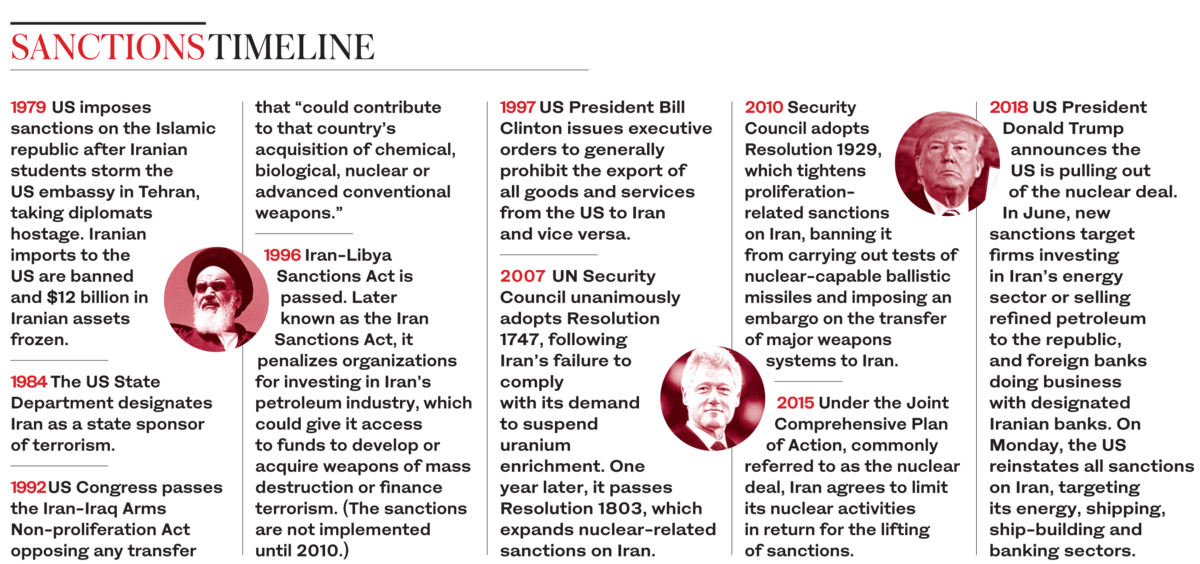

How US sanctions will hit Iran

DUBAI: While Iran braces for a new set of sanctions on Monday that will target its oil, shipping, energy and banking sectors, US measures have already taken a heavy toll on the Islamic republic.

As part of the new sanctions, the US Treasury Department will add more than 700 names to its list of blocked entities as of Nov. 5, with the US working closely with countries to cut off Iranian oil exports as much as possible.

The State Department said on Friday it has closed the “Obama-era condensate loophole,” which allowed countries to continue importing the byproducts of oil and natural gas from Iran even while sanctions were in place.

“This loophole allowed millions of dollars to continue to flow to the regime,” said Secretary of State Mike Pompeo. “These sanctions hit at the core areas of Iran’s economy, and they are necessary to spur changes we seek on the part of the regime. The maximum pressure we imposed has caused the rial to drop dramatically, the country’s Cabinet is in disarray, and the Iranian people are raising their voices even louder against a corrupt and hypocritical regime.”

The impact of the sanctions was felt early on, with their announcement in May driving many companies to abandon Iran, causing the value of its currency to plummet.

“The impact will be severe, and we see it in the acute economic situation in Iran today,” said Riad Kahwaji, founder and CEO of the Institute for Near East and Gulf Military Analysis in Dubai. “They will definitely have a gradual escalating impact on economic conditions and, subsequently, on the relations between Iran and the US. The main objective from the US side is to force Iran to accept most — if not all — of its 12 conditions and demands.”

Kahwaji said the sanctions’ primary objective is to get Iran to return to negotiations and agree to a new treaty, whereby it would restrict its ballistic missile program and remove the so-called sunset clause for its nuclear program. That would entail banning Iran from returning to enrichment activities.

“The current restrictions will become permanent, including (elements) related to what the US calls Iran’s behavior in the region,” he said. “So the ultimate objective is to pressure Iran to get back to the table of negotiations as per the terms of US President Donald Trump’s administration.”

It is believed that the new sanctions will compel Tehran to renegotiate the Joint Comprehensive Plan of Action (JCPOA). Experts say Trump believes the last deal was the worst ever struck by the US.

“The sanctions will force Iran’s hand as Mike Pompeo argued that at the rate that the Iranian economy is declining, and protests are intensifying, it should be clear to the Iranian leadership that negotiations are the best way forward,” said Dr. Albadr Al-Shateri, politics professor at the National Defense College in Abu Dhabi.

“However, if history is any guide, the Iranian regime will (complain) but try to approach the administration in back channels. The purpose of this secretive communication is to give the impression of Iran’s willingness to compromise and thus prevent the further deterioration of the relationship with the US lest the Iran hawks in Washington push for military action.”

He said that, in parallel, Iran will look more defiant in the public eye, with the potential of the Islamic republic dragging negotiations out for a couple of years.

“(It might) give few concessions in regional crisis points like Syria and Yemen, and hope for a regime change in Washington,” he said. “Perhaps a democratic administration will be more susceptible to a new deal that will reaffirm the JCPOA with a different nomenclature. The new sanctions might prove to be costly if the Kingdom of Saudi Arabia, with spare production capacity, is unable or unwilling to put more oil in the market.”

Al-Shateri said the expected increase in oil prices might offset Iran’s loss of oil exports because of the US sanctions. “Moreover, the US attempt to cut off Iran from the international financial system, SWIFT, might also spur the Europeans and others, who are against the US withdrawal, to find a different financial system to circumvent the dollar exchange,” he said. “That may spell the beginning of the end of the dollar hegemony.”

Controversy arose when the sanctions were announced in terms of Iran’s access to the SWIFT financial system and its potential to bypass the sanctions through it. “SWIFT is no different than any other entity, and we have advised SWIFT the Treasury will aggressively use its authorities as necessary to continue intense economic pressure on the Iranian regime,” said Steven Mnuchin, US Secretary of the Treasury.

“SWIFT (will) be subject to US sanctions if it provides financial messaging services to certain designated Iranian financial institutions. We have also advised SWIFT that it must disconnect any Iranian financial institution that we designate as soon as technologically feasible to avoid sanctions exposure.”

Humanitarian transactions to non-designated entities will be allowed to use the SWIFT messaging system as they have done before, but banks were warned to be cautious that these are not disguised transactions, or they could be subject to certain sanctions.

“The list of banks, which will be substantially longer than last time, will be coming out (in the coming days),” he said. “And as it relates to monitoring transactions, financial institutions have liability for any transactions that go through SWIFT or any other mechanisms. It’s our expectation that will be implemented as soon as technologically feasible.”

The Iranian public is also expected to be affected by the economic sanctions.

“On the domestic front, there will be a major impact on Iran’s ability to fund,” Kahwaji said. “It will be (faced with) a choice — whether to continue giving priority to its international operations serving its expansionist schemes or use whatever cash it has to ease the internal situation and serve the public. We will have to wait and see how the Iranians try to manage the situation in government, but it’s not going to be easy as the situation will worsen by the day.”

He described the sanctions as the “strongest tool” the US holds, before resorting to military means, to pressure the Iranian regime to adhere to its demands.

“Essentially the sanctions that were taken off are snapping back,” said Katherine Bauer, the Blumenstein-Katz Family Fellow at the Washington Institute. “Over this 180-day wind-down period, what we have seen is firms and financial institutions have reacted very quickly; likely they had plans on the shelf as there was a snap-back scenario.”

The US withdrawal from the nuclear deal has already had a huge effect, including the devaluing of the Iranian rial and oil exports falling by about a million barrels a day. “This is a substantial drop,” she said, adding that the ultimate goal was to deprive the regime of revenue it gets from oil.

Experts predict oil exports will drop further in the near future. “There is a clear loss of revenue coming from a significantly reduced sale of oil,” said former ambassador Dennis Ross, a counselor and William Davidson Distinguished Fellow at the Washington Institute for Near East Policy. “We have also seen the decline of the rial. For the Iranian public, they have seen their bank accounts affected as a result.”

While the International Monetary Fund had projected Iran’s economy to reflect a 4 percent growth next year, he said it has now updated its projection to an estimated 3.6 percent decline. “There are real pressures in play and Iran is certainly going to be feeling those pressures,” he said.

“We know that the Iranians developed all sort of techniques to avoid the sanctions in the past, and we are likely to see this again. Oil exports, for example, are bound to be leaked through Iraq, and potentially through Afghanistan and Turkey.”